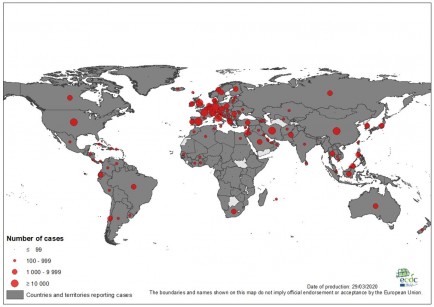

Home values in Xi-an, China, grew faster than 150 major cities around the world in the second quarter of 2019, according to a report released Wednesday by Knight Frank, a U.K.-based real estate company. The Chinese city saw a 25.1% rate of annual growth compared to the same time period last year, the Knight Frank Global Residential Cities Index found. The index uses official statistics to track the movement of mainstream residential prices across 150 international cities.

Xi’an beat out Budapest, Hungary, which had an annual growth rate of 24.2% for the second quarter of 2019. However, the European city has the largest growth rate for the last five years, with home prices more than doubling during that time. Izmir, Turkey, had the second highest growth rate for the last five years at 80%, the index found.

Still, on the whole, average growth around the world has slowed, according to Knight Frank.

“The index continues to track lower recording average growth of just 3.5% in the year to June 2019, down from a high of 6.7% at the end of 2016,” Kate Everett-Allen, Knight Frank’s head of international residential research, said in the report. “Rising economic uncertainty, trade tensions, political crises and affordability concerns are leading to weaker sentiment in mainstream housing markets.”

The Indian cities of Hyderabad, 18.3%, and Ahmedabad, 15.3%, had the third and fourth highest growth rates over the last year, the index found. Other Chinese cities in the top 10 include Wuhan and Chongqing, with annual growth rates of 14.6% and 12.1%, respectively. Europe’s Porto, Portugal (13.6%), Zagreb, Croatia (11.4%), and Athens, Greece, (11.2%) also made the top 10.

Phoenix, Arizona, had the highest annual growth in the U.S., at 5.8%, the data showed. But it was still 41st on the global index. The report also noted the “widening gap between cities in the same country,” such as the difference between Phoenix and Seattle, which had a -1.3% annual growth rate.

“Local economic fortunes, opposing market cycles and in some cases, tighter property market regulations are behind this divergence,” Ms. Everett-Allen wrote in the report.

Top-tier locations like London, New York, Auckland, Rome, Dubai and Sydney are all the bottom third of the index rankings this quarter, the data found.

“In a number of these cities, the prime sector continues to outperform the mainstream market,” according to Ms. Everett-Allen. “In others, analysis of price movements in the last quarter suggest their rate of decline is starting to slow.”

Original article: https://www.mansionglobal.com/articles/soaring-home-values-in-xian-and-budapest-defy-global-slowdown-208048

Comments